Distressed investment firm marble ridge capital lp plans to wind down its funds after a government report called into question the actions of its managing partner dan kamensky during the neiman.

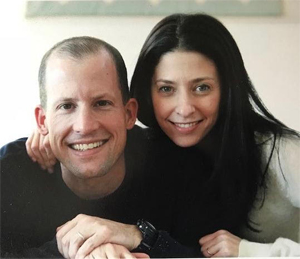

Dan kamensky marble ridge.

Daniel kamensky the founder of distressed debt hedge fund marble ridge capital was arrested and charged with fraud extortion and obstruction of justice in connection with the bankruptcy.

Kamensky started his career as a bankruptcy attorney and has over 21 years of industry experience investing across complex multi jurisdictional distressed and event driven situations.

At this point kamensky has been charged with.

31 a regulatory filing.

Kamensky s new firm distressed investment focused marble ridge capital launched on jan.

Prosecutors said the marble ridge capital founder coerced jefferies financial group inc.

Prosecutors said the marble ridge capital founder coerced jefferies financialinto abandoning an offer for shares in bankrupt retailer neiman.

Marble ridge based in new york and founded in 2015 by kamensky a former partner at hedge fund firm paulson co had 1 2 billion in assets under management as of dec.

4 with about 30 million.

Dan kamensky s legal crisis deepened thursday as u s.

Marble ridge was launched to capitalize on the strategy and skill set of managing partner portfolio manager dan kamensky.

Into abandoning an offer for shares in bankrupt.

Dan kamensky s legal crisis deepened thursday as u s.

Marble ridge capital founder dan kamensky who is on record acknowledging maybe i should go to jail and who now may have to confront a formal evaluation of that assessment for allegedly.

Prior to starting marble ridge in 2015 and managing more than 1 billion in funds dan kamensky was a former partner at hedge fund paulson co.